Most businesses know that Customer Lifetime Value (CLV) is an important metric to optimize marketing efforts, initiatives, and budgets.

Based on that specific number, you will have a better sense of how much you can spend on customer acquisition, how much you should invest into your existing customers, and you can define strategies and a budget to increase your Customer Lifetime Value in eCommerce or retain your high-value customers

Start a loyalty program, reward customers with loyalty points whenever they do what you want, and watch how LTV grows!

There are a few ways you can predict your CLV, either through the aggregate model or the machine learning model. We’ll walk you through both of these models in this article.

What is Customer Lifetime Value?

Customer Lifetime Value is the amount of monetary value a customer will bring to your company during their lifetime, from the first to the last purchase. In other words, it is a number that represents the total amount spent by a single customer on your products or services over their lifespan.

There are several ways to calculate Customer Lifetime Value, but to do that, you first need to gather the following data:

- Average Order Value / Average Transaction Value

- Average Purchase Frequency Rate

- Average Customer Lifespan

Why is Predicting Customer Lifetime Value Important?

Calculating your CLV will help you understand how your customers have historically interacted with your business and predict how they may interact with you in the future. You can pinpoint trends, such as the length of your typical customer’s lifespan, their purchasing behavior, and most importantly, how much revenue you tend to make from a single customer.

Once you have this data, you can use it to help identify your top customers based on their spending habits. This will give you more focus as you look to grow more profitable relationships with your current and future customers.

In a more tangible sense, this metric can also help you to better allocate your marketing resources and prevent churning (or attrition).

Customer Lifetime Value Prediction Models

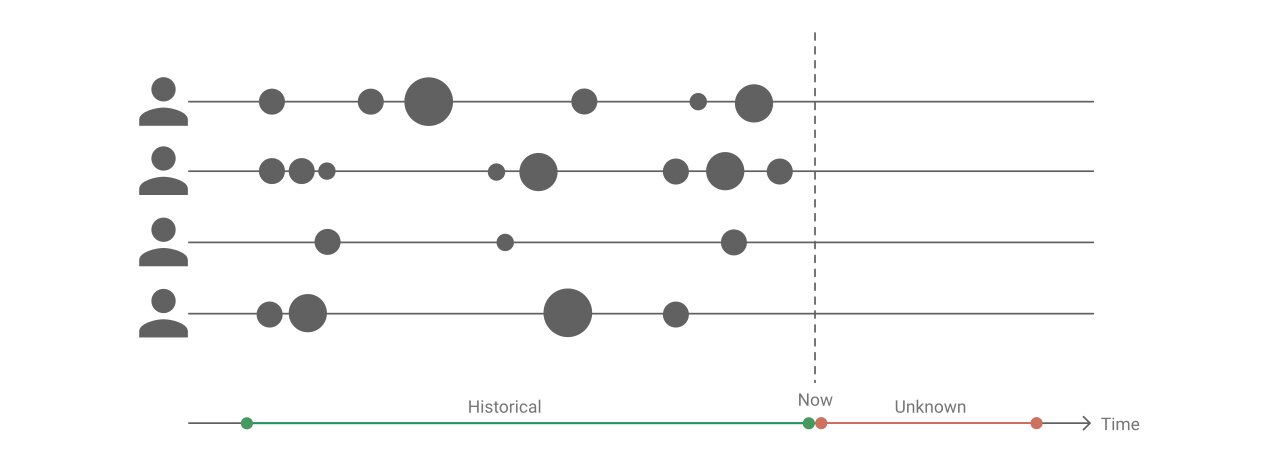

Customer Lifetime Value prediction uses historical data to predict future sales. There are several ways (models) you can use to calculate these numbers.

It’s important to understand that different models use and gather different past data a little bit differently. Some are simpler and offer a more general number; others, like the machine learning models, use additional data and a robust algorithm to give you a much more complete overview of your customers and their particularities.

Let’s dive into those models a little bit further:

1. Aggregate Model

The Aggregate Model is probably the most common method out there. It has been around the longest, and it is the most straightforward way to calculate CLV. The aggregate model uses a constant spend rate and churn for all clients. In this method, we have a single CLV, or in other words, a single group of customers rather than individuals.

Since this model creates one single CLV predicted value, there might be some drawbacks to using it. Because all of your customers are grouped together, you might see a higher customer churn due to seasonality or a higher monetary value for transactions because of a few “big spenders” that influence the overall value.

2. Cohort Model

As the name says, this model uses cohorts to group customers and then calculates the CLV for each group. The preposition here is based on the principle that customers grouped in a cohort have the same spending patterns or fairly similar behavior patterns.

The algorithm will create cohorts based on your customers’ start date (by month). We usually consider the months of the year to group clients since each month usually has different marketing campaigns targeted to reach different kinds of people that, therefore, might be characterized by different behavior patterns.

3. Probabilistic Model

There are several probabilistic models that are commonly used to calculate CLV predictions. They all use the same data mentioned before (Average Order Value, Purchase Frequency, Customer Churn), but they have slightly different approaches and probability distribution.

Some of the models often used by companies are:

- Pareto/NBD Model

- BG/NBD Model

- MBG/NBD Model

- BG/BB Model

- Gamma-Gamma Model

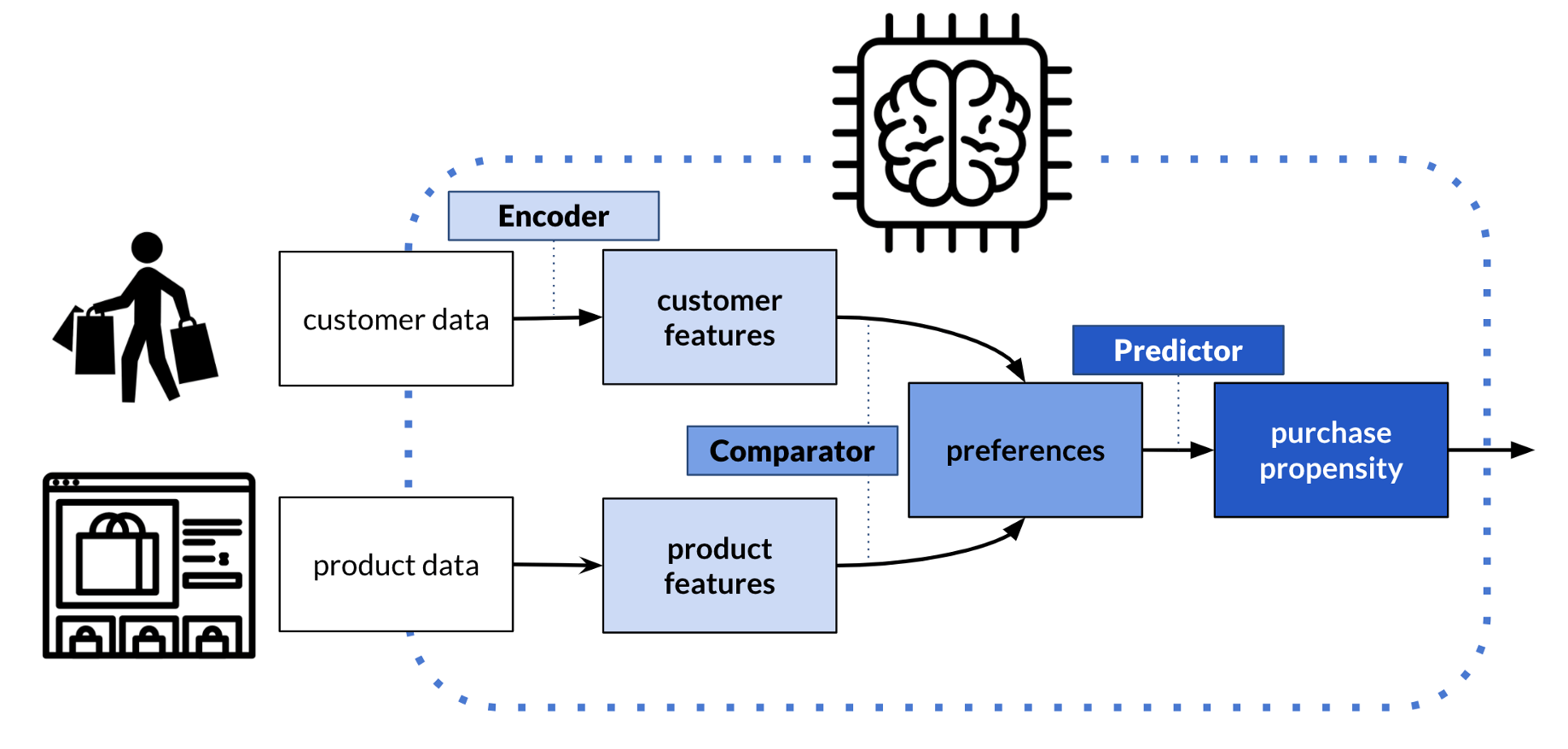

4. Machine Learning Models

Machine Learning (ML) is an essential Artificial Intelligence (AI) tool that can help predict CLV with great accuracy. This is because the ML models use algorithms that find patterns in the data you’ve collected to more accurately forecast future customer behaviors – which has enormous benefits, as we mentioned earlier in this article.

As part of the machine learning process, we will also estimate the Recency, Frequency, and Monetary Value (RFM) for the transactions. This helps give you a clear overview of each user’s average purchase amount, lifetime duration, and their frequency of purchase.

For this type of model to work, you need to have previous data and prepare it so the algorithm can do its job. This process involves removing duplicates and getting rid of empty fields or data that are incorrectly formatted. In the end, it doesn’t matter which machine learning model you choose; you will need to prepare and clean up your data first.

What Kind of Data Do Machine Learning Models Use?

Here are some of the data points that machine learning typically takes into account:

- Invoice Number

- Invoice Date

- Customer ID

- Product Code

- Product Name

- Quantity

- Unit Price

- Country Where the Customer Resides

How Do You Predict CLV?

You can predict Customer Lifetime Value by using one of the models mentioned above. The best and most accurate way to do it is through machine learning.

If you own an eCommerce store, you can find software that does all the hard work for you. Nowadays, software like Verfacto uses data analysis to predict your CLV and gather other important information to help you increase your profit margin and optimize your marketing budget.

Verfacto works with Shopify, WooCommerce, Magento, PrestaShop, and OpenCart. It offers data-driven insights for your company’s marketing based on AI analytics.

How Can You Increase CLV?

Once you receive your Customer Lifetime Value calculation, you may find that you have room to improve. If that’s the case for you, don’t worry. There are many ways to improve your CLV and get a better understanding of what your customers need.

Knowing your CLV predictions can help you optimize and improve your processes so you can get better results in the future. If you’re interested, we’ve written an article with some of the best tips to increase your Customer Lifetime Value.

If you’re short on time, there are a few basic tips we can share with you right now to help you improve your CLV:

1. Create Value-Oriented Content

Instead of focusing on the product itself, value-oriented content focuses on the product’s benefits to the customer. You can think of it like this:

If you sell lipstick, you’re not selling just lipstick. You’re selling the beauty, the confidence, the feeling that your product provides your customer. If you sell a luxury watch, you’re not just selling a watch. You’re selling status, admiration, power, and confidence.

You should always create content that offers value, whether that means educating your audience about your product, showing them how it helps them with their needs, or otherwise adding to their quality of life in some way.

2. Offer Discounts at the Right Time

When you use tools like Verfacto, it’s easy to pinpoint the exact right time to offer your customers or leads a discount that will help increase conversions without hurting your bottom line.

By utilizing a customer segmentation software, you can send offers to the right people at the right time and even push hesitating users to take action.

3. Offer Top-Notch Customer Service

Customer service is one of the most important factors that influence Customer Lifetime Value. When you have excellent customer service – before and after the sale – you increase the chances that customers will become more loyal to your brand.

This of course means they will spend more, but it also means they will help promote your business through word-of-mouth referrals, and thus, lower your customer acquisition costs.

Consider offering comprehensive customer support and use Omnichannel Analytics to your advantage by assisting wherever your customer may need a little extra care.

4. Use Upselling and Cross-Selling Strategies

Another great way to increase CLV is to use upselling and cross-selling strategies. These two tactics are great ways to increase the average order value without increasing product price.

The strategy works like this: whenever customers are shopping, you can offer them a product that is either complementary to the one they are buying (cross-sell) or better than the one they are currently looking at (upsell).

Of course, the recommendations should be well done and be showcased at just the right time. Without the correct strategy in place, you could actually see a negative result, so make sure your strategies are backed up by research and expert tools.

5. Get the Most Out of Data-Driven Marketing

Data-driven marketing is a great asset, especially for online businesses. Data shows that this kind of marketing increases ROI by 5-8x. It helps you increase conversions based on actual data by segmenting users, customizing pop-ups, automating emails, and predicting users’ behaviors.

If you want more information on this, we’ve created a few articles that will help you to understand the benefits of data-driven marketing and see some actual examples so you can get inspired to try this out.

Final Thoughts

Customer Lifetime Value prediction is a great way to get valuable insights about your customer acquisition, marketing efforts, and your company’s financial future.

When you are able to see how much revenue a client can generate during their lifetime, you can reallocate your resources and efforts to see a more significant profit and build a long and positive relationship with your customers.

With machine learning solutions, you can easily predict the future of customer behavior based on previous data. The AI solutions will give you the precise information you need to create a customer experience to create optimal results for everyone involved.

Implement LTV attribute into your PPC, Email or On-site marketing campaigns and. Use it as a custom trigger or a way to segment your audience.